Africa: The Future Global Workforce Hub

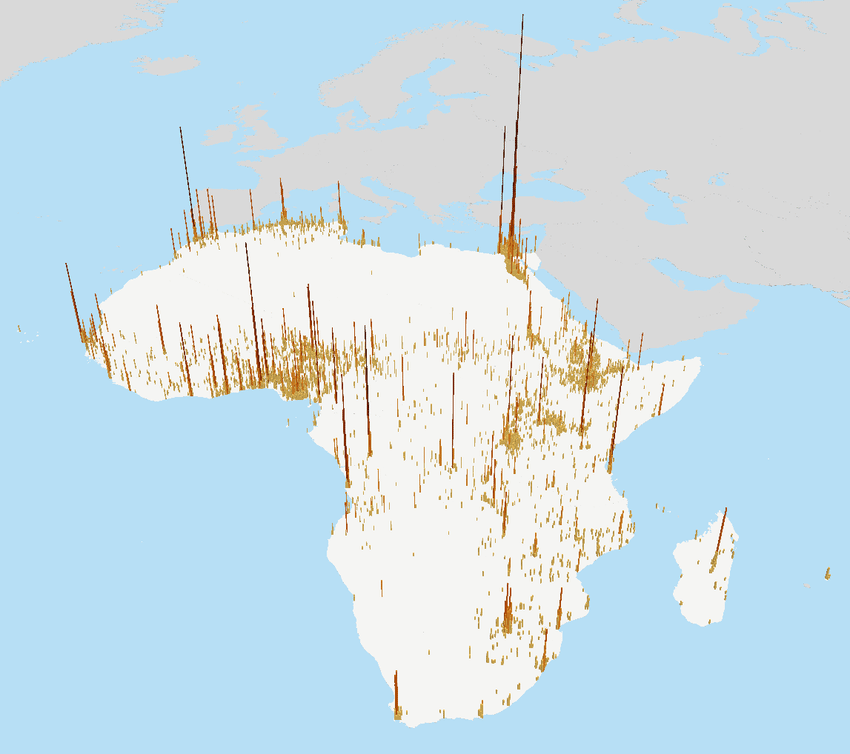

In just under three decades, the global workforce landscape will undergo a dramatic shift. Today, the largest workforces are in South Korea, China, Brazil, and Colombia. By 2050, the young, dynamic workforce that will power the world will predominantly be in Africa. This emerging demographic reality presents a compelling reason to invest in Africa.

Demographic Dividend: A Catalyst for Economic Transformation

By 2050, Africa will experience a demographic dividend, with a majority of its population in the working age bracket. This demographic shift will drive massive economic benefits for the continent. According to Africa Investment Consortium projections, the best-balanced workforces will mostly be in Africa. This shift holds the potential to reshape economic growth and geopolitical power balances.

A New Era of Economic Opportunity

Imagine the exponential growth potential this demographic dividend will unlock. Africa could become the center of global commerce, driven by a robust, youthful workforce. However, realizing this vision requires unprecedented collaboration among corporations, universities, investors, funders, and venture capitalists (VCs) to channel investment flows into Africa.

Entrepreneurship: Africa’s Untapped Potential

Africa’s population is fast approaching 1.5 billion people, with the continent boasting the highest rate of entrepreneurship in the world. According to the African Development Bank, 22% of Africa’s working-age population are starting new businesses, highlighting the continent’s entrepreneurial spirit.

However, the biggest challenge threatening this potential is the lack of funding for entrepreneurs. In the first half of 2023, foreign venture capital investment into Africa fell by 43%, with tech startup investments plunging by 48%. This funding gap risks transforming the region into an import economy rather than an export-driven one, leading to massive lost opportunities.

Bridging the Funding Gap: The Role of Africa Investment Consortium

To harness Africa’s potential, private companies in Africa must leverage their cash reserves to invest in startups and seed capital, ensuring balanced portfolios across gender and race. Underinvestment, especially in female founders, has hindered the continent for decades. Changing this investment paradigm can lead to exponential economic growth, similar to the transformation seen in Japan and South Korea when they capitalized on their demographic dividends.

Africa Investment Consortium (AIC) plays a crucial role in this transformation. As a transaction advisory and investment facilitation firm, AIC works with governments, investment corporations, and development agencies to finance public and private sector projects in Africa. AIC acts as an intermediary for African governments and companies seeking to raise capital, offering capital-raising services to both large enterprises and SMEs. By connecting businesses with financing sources, communicating their value, and negotiating investment terms, AIC oversees the complete investment process from start to finish.

Building the Future: Investing in Startups with AIC

Investing in seed rounds and startups can build companies that evolve into SMEs or even Unicorns, becoming economic game-changers. AIC is uniquely positioned to facilitate these investments, leveraging its extensive network and expertise to ensure successful outcomes. With just 2% of pension funds and corporate money directed towards venture capital, the impact could be transformative.

Conclusion: Seizing the Moment with Africa Investment Consortium

The time to invest in African startups and businesses is now. By partnering with Africa Investment Consortium, investors gain access to the continent’s vast potential, contributing to a future of global economic stability and growth. AIC’s strategic approach and comprehensive services make it the best avenue for channeling investments into Africa. Let’s act now, with AIC leading the way, and be part of Africa’s journey towards becoming the next global powerhouse.