CoinMENA, a leading digital assets exchange in the Middle East and North Africa (MENA), today announced that it has joined Visa’s Fintech Fast Track program, speeding up the process of integrating with Visa, a world leader in digital payments.

The Visa Fintech Fast Track program will allow CoinMENA to more easily leverage the reach, capabilities, and security of VisaNet, the company’s global payment network, and launch a host of Visa-exclusive services, including the CoinMENA VISA Card. The company will also leverage the Visa Fintech Fast Track program to introduce a series of partner initiatives specifically designed to simplify onramp and offramp operations for its users. If you want to be among the first to receive your CoinMENA Card, get on the waitlist by signing up here: https://www.card.coinmena.com/

CoinMENA is a Bahrain-based cryptocurrency financial services company that is licensed and regulated by the Central Bank of Bahrain (CBB). By allowing investors to connect their bank accounts with their CoinMENA wallets directly, the platform provides access to non-traditional investment options, helping to democratize the new digital economy in the MENA region. CoinMENA users can buy, sell, store and receive digital assets safely and securely, as well as make deposits and withdrawals in their local fiat currencies. CoinMENA’s overarching goal is to become the preferred crypto financial services company in its region.

By joining Visa’s Fintech Fast Track program, CoinMENA now has the ability to access Visa’s growing partner network, and experts who can provide guidance in helping them get up and running in the most efficient way possible. Learn more about Visa’s Fintech Fast Track program at https://Partner.Visa.com.

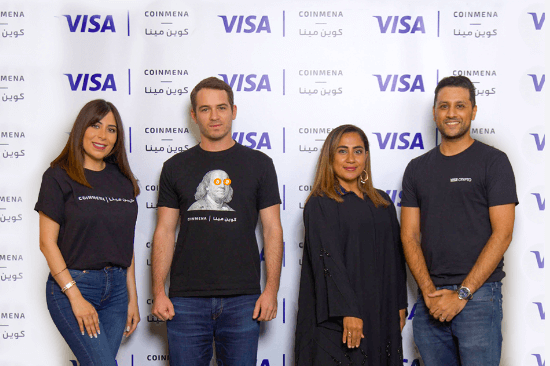

Commenting in a joint statement, CoinMENA Co-Founders Dina Sam’an and Talal Tabbaa said: “We are delighted to have entered into this five-year strategic partnership with Visa. Joining forces with one of the largest payments technology companies on the planet will enable us to further expand and enhance the user experience for CoinMENA’s userbase.”

“The Visa Fintech Fast Track program will enable CoinMENA to gain access to Visa’s global network, not to mention a whole host of partnership opportunities,” said Tabbaa. “This is excellent news for our users, who will benefit from a diverse array of incentives as well as greater flexibility than ever before.”

“As a Visa Fintech Fast Track partner, we will be able to offer more convenient transaction and payment solutions for our community,” Sam’an added. “This is a huge milestone for both CoinMENA and the sector as it signals to the market that crypto adoption is going mainstream.”

Alex McCrea, Visa’s Vice President, Head of Strategic Partnerships and Ventures for Central Europe, Middle East and Africa, said: “At Visa, we want to serve as the bridge, connecting the crypto ecosystem with our global network of 100M merchant locations and 15,000+ financial institutions. We are excited for CoinMENA to join Visa’s Fintech Fast Track program given its growth trajectory and solutions roadmap. With the Visa Fintech Fast Track program, we provide leading virtual asset exchanges like CoinMENA with rapid onboarding, industry know-how and investments to gain access to the capabilities that lie within Visa’s global network.”

About CoinMENA

Headquartered in the Kingdom of Bahrain, CoinMENA is a digital assets exchange that is licensed and regulated by the Central Bank of Bahrain (CBB). CoinMENA seeks to empower new and seasoned investors in the MENA region who want access to non-traditional investment options by allowing them to participate in the new digital economy. Through CoinMENA, investors can buy, sell, store, and receive digital assets safely and securely, as well as deposit and withdraw in their local currency. Through competitive fees, high liquidity, and an educational approach, CoinMENA aims to be the simplest and most trusted digital assets exchange platform in the region.